Table of Contents

- Executive Summary

- Market Categories and Deployment Types

- Decision Criteria Comparison

- GigaOm Radar

- Solution Insights

- Analyst’s Outlook

- Methodology

- About Dana Hernandez

- About GigaOm

- Copyright

1. Executive Summary

The e-signature market continues to show sustained and accelerated demand across virtually every industry sector. Document execution processes are a core component of most businesses, and supporting traditional physical processes for high-volume use cases is too costly and inefficient to justify them. Businesses are no longer asking if an e-signature solution should be adopted; instead, as more players enter the market, they are asking which solution to choose.

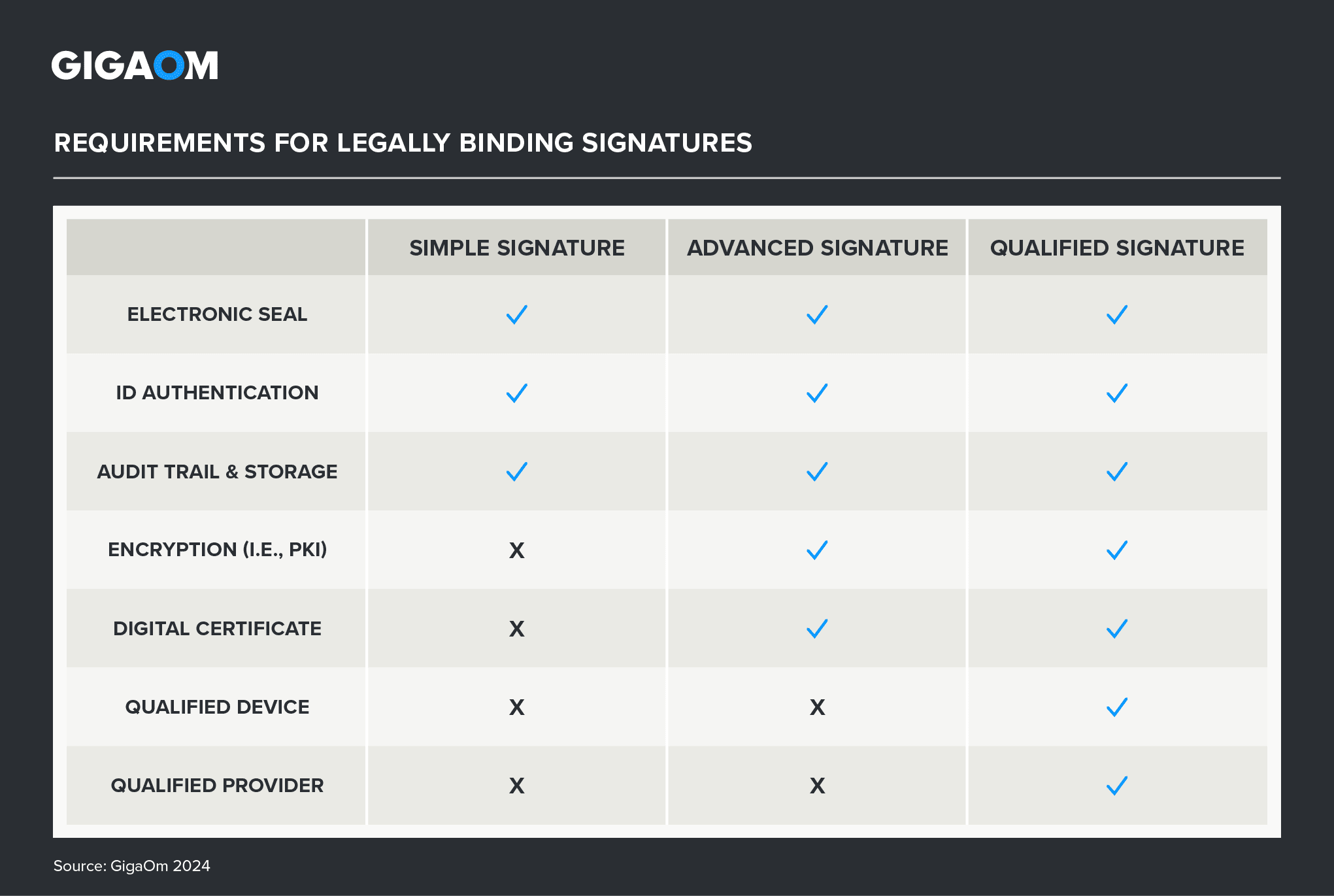

E-signature solutions have been available for decades and have matured into a robust domain that is well prepared to meet increases in market demand. Vendors continue to invest in more extensive jurisdictional support, enabling direct integration with numerous country-specific electronic identity (eID) services. Qualified digital signatures (QES) were once considered advanced functionality but are now more commonplace (as shown in Figure 1), with leading solutions offering five or more integrated trusted service providers (TSPs) in addition to supporting the Electronic Signatures in Global and National Commerce Act (E-SIGN Act) and the Uniform Electronic Transactions Act (UETA) in the US.

Figure 1. Requirements for Legally Binding Signatures: Simple, Advanced, and Qualified

Similarly, identity authentication methods have expanded as well, with many solutions offering advanced features to verify signees, including video, document verification, and biometric functionality. Aside from documents that are still legally not in scope for electronic execution (for example, wills and court orders), even the most complex international use cases can be supported by multiple vendor offerings.

Beyond core compliance, almost the entire market of customers has started or continued to invest in end-to-end document management software. Commonly referred to as contract lifecycle management (CLM), this investment expands e-signature functionality to other document functions, such as creation, negotiation, and post-execution processing. This represents a shift in how businesses view e-signatures: no longer as a point solution but as part of a broader transformation strategy that aims to drive automation and digitization across all document activities.

As a result, broader platforms have started integrating other workflow capabilities within e-signature products, blurring the line between document management and this solution space. Often, e-signatures are the entry point but quickly become part of a multiple-product package whose components work together within an ecosystem to produce more comprehensive transformation. Feature-focused offerings are investing in similar expansion as well, though they’re more heavily reliant on native functionality combined with expanded third-party integration options. One example is data field configuration, which now commonly enables automated population of and extraction into domain systems, thus supporting requirements before and after the e-signature function.

To be a significant player in this space, an e-signature solution must support the core e-signature process—preparation, distribution, execution—and offer extensive compliance support, scalability for high-volume use cases, and flexibility across a range of countries, languages, and interfaces. Functionality that simply allows a user to draw a signature on a document is not sufficient to be considered a solution for this report. Recent entrants Microsoft and Google are excluded for this reason, but expect them to be more significant alternatives in the near future.

This is our third year evaluating the e-signature space in the context of our Key Criteria and Radar reports. This report builds on our previous analysis and considers how the market has evolved over the last year.

This GigaOm Radar report examines 14 of the top e-signature solutions in the market and compares offerings against the capabilities (table stakes, key features, and emerging features) and non-functional requirements (business criteria) outlined in the companion Key Criteria report. Together, these reports provide an overview of the market, identify leading e-signature offerings, and help decision-makers evaluate these solutions so they can make a more informed investment decision.

GIGAOM KEY CRITERIA AND RADAR REPORTS

The GigaOm Key Criteria report provides a detailed decision framework for IT and executive leadership assessing enterprise technologies. Each report defines relevant functional and non-functional aspects of solutions in a sector. The Key Criteria report informs the GigaOm Radar report, which provides a forward-looking assessment of vendor solutions in the sector.